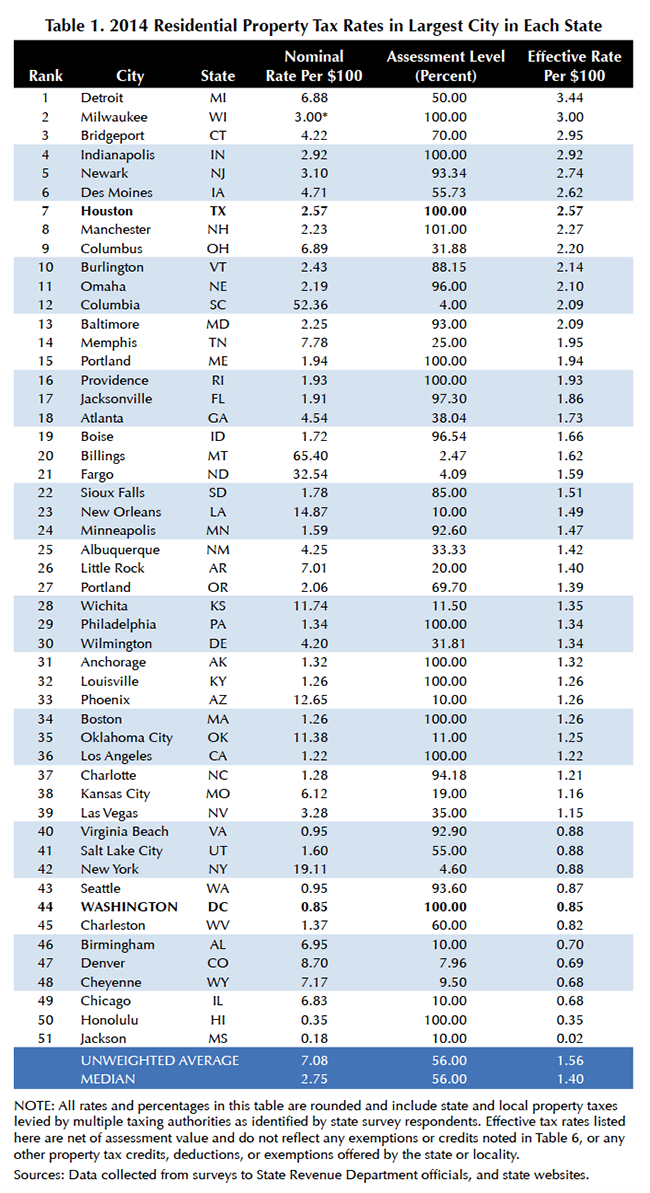

Texas Tax Registration: Those businesses operating within the state of Texas are additionally required to register for more specific identification numbers, licenses or permits for different tax purposes. Examples of these include income tax withholding, sellers’ permits for sales and use tax, and unemployment insurance tax. In order to claim the exemption a taxpayer must file Form 5076 Small Business Property Tax Exemption Claim Under MCL 211.9o with the local unit where the personal property is located, no later than February th, postmark is acceptable.20 The burden of proof remains with the taxpayer to demonstrate postmark by February 20th.

- Guide To Houston Small Business Taxes

- Guide To Houston Small Business Tax Credit

- Guide To Houston Small Business Tax Relief

Guide To Houston Small Business Taxes

View Webinar

View WebinarViewing this webinar requires some basic information. This data is only used within SCORE and will not be distributed to any third parties.

Guide To Houston Small Business Tax Credit

As an owner or manager of a small business, you may be responsible for tasks beyond your areas of expertise, such as HR, compliance and employee benefits. These duties can be extremely complex and, if not managed properly, can lead to government fines or even litigation.

This webinar, presented by Yazmin Perez-Lopez with Paychex, will cover rules, regulations and best practices on topics you may encounter once you have employees.

Guide To Houston Small Business Tax Relief

You’ll learn useful tools and tips for:

- Employee communications

- Benefits

- Safety and loss prevention

- Compliance

- Employee motivation and development

- Employee separation

- Health care reform

- Handbooks

Prepare for this webinar by reviewing the HR 101 - Hiring, Onboarding and Paying Employees session.

Download the webinar transcript.